Welcome back to Deep Tech Catalyst, the channel by

where science meets venture!Today, we're happy to welcome back Daniel Franke, Investment Director at M Ventures!

We explored a simulated scenario delving into exit waterfalls, and the importance of understanding them for founders, and introduced the fundamental negotiation terms in venture capital.

Here's what you will get from the episode:

🧮 Understanding the basics of an Exit Waterfall

📃 Liquidation Preferences

📚 An Exit Scenario Analysis

📈 Impact of Liquidation Preferences on Founders and Investors

🍰 Strategic Considerations and Market Realities

🎧 Prefer to Listen?

Before diving into it, an important disclaimer:

This content is provided solely for educational and informational purposes and should not be interpreted as financial or legal advice. While we strive to clarify the complexities surrounding various agreements and provisions, the nuances can be overwhelming. It is essential for entrepreneurs and founders to consult directly with a qualified legal or financial professional to navigate the legal and financial landscapes effectively.

Understanding these topics goes beyond merely knowing the terms; it involves grasping their implications for your ownership, control, and the broader future of your company. Preparing for a range of outcomes and being well-informed about how different scenarios might impact your stake in the business is paramount.

KEY INSIGHTS FROM THE EPISODE

🧮 What is an “Exit Waterfall”?

In the context of a startup, an "exit waterfall" describes how funds are distributed among shareholders following an exit, such as the sale of the company.

In detail, the "waterfall" distribution system in venture capital ensures that investors are paid in a sequence based on their order of investment, with later investors often having more advantageous terms. This sequence impacts how funds are distributed among seed investors, pre-seed investors, and founders, particularly after a company sale.

It is crucial for scientific founders to understand this before launching their startups because it is one of the first terms negotiated when signing an investment term sheet.

This negotiation typically includes discussions on valuation, the amount of money raised, and board composition. However, a key term often negotiated between founders and investors is the liquidation preference.

📃 Liquidation Preference & Exit Scenarios

A liquidation preference is a clause in a contract that dictates the payout order in case of a corporate liquidation (Investopedia).

In other words, it defines the framework that dictates how money is distributed in various exit scenarios. These scenarios can range from:

Highly successful exits, where a small startup grows into a massive company worth billions.

Moderate exits that are not necessarily blockbuster successes but still yield a reasonable return.

Less favorable exits, where the company might sell for a fraction of its value.

Types of Liquidation Preferences

There are primarily two types of liquidation preferences:

one-time non-participating

one-time participating

Each type dictates different payout rules during an exit, affecting how funds are distributed among shareholders.

Understanding these preferences is crucial for founders, especially those transitioning from academic or scientific fields to entrepreneurship, as it influences their financial outcomes during exit events.

We'll start with the non-participating preference.

📚 A Scenario Analysis

Before diving into the topic, it’s important to understand that the term "exit waterfall" specifically refers to the economic model that calculates the payout sequence during an exit. It implies that not all shareholders are paid simultaneously.

There are rules about the sequence in which investors reclaim their investments, typically prioritizing certain share types like preferred stock over the common stock held by founders and employees.

This distinction was explored in a previous episode (link below) where the differences between preferred and common stock were discussed.

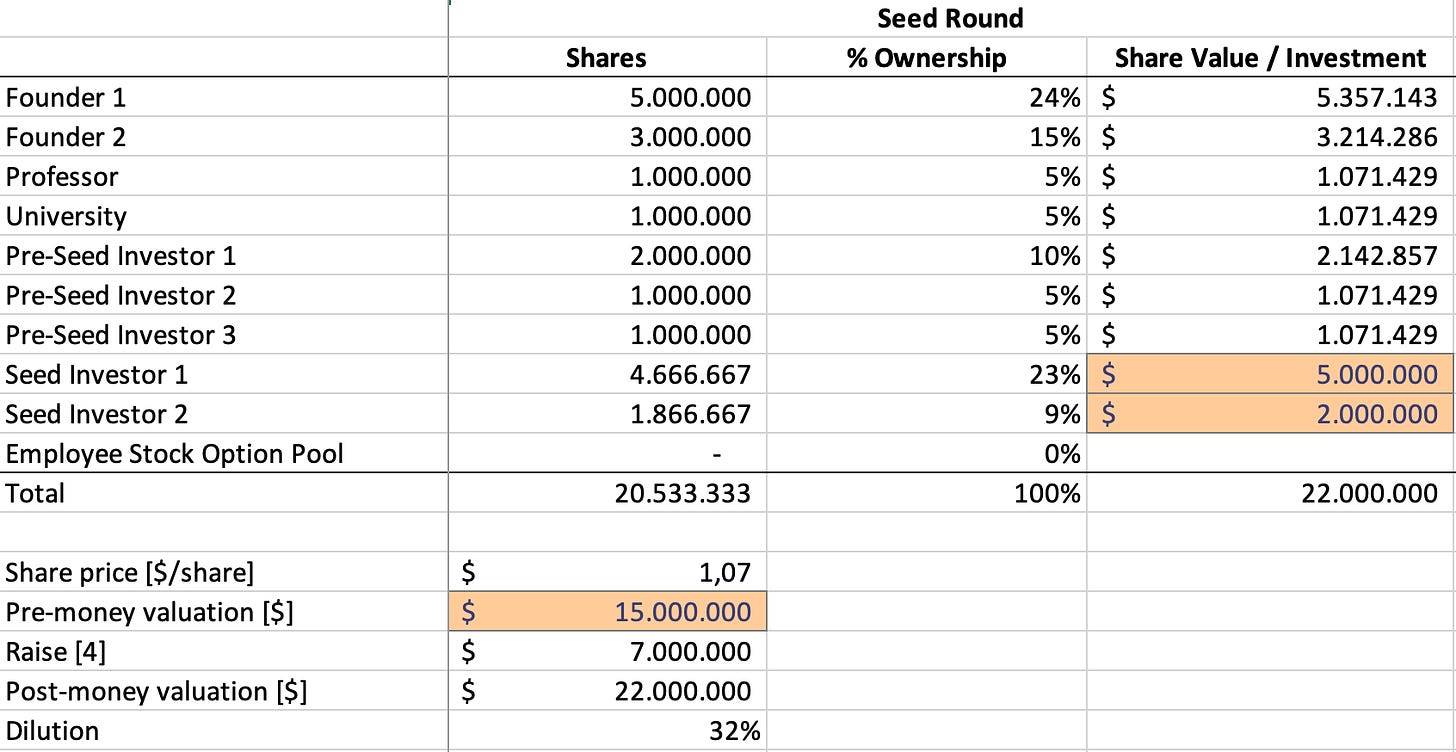

During our last episode, we simulated an exit scenario based on a hypothetical university spinout with two founders. We’ll start from here. The model included two rounds of VC funding—a pre-seed round with $2 million and a seed round with $7 million.

Although not all companies exit immediately post-seed rounds, this model helps illustrate the concept of liquidation preferences and provides a foundational understanding of how they work, even if further investment rounds are added later.

In this scenario, the seed investors invested $7 million, and the pre-seed investors invested $2 million.

Subsequently, the ownership percentages post-seed round are as follows:

Seed investors own 32%

Pre-seed investors own 19%

Founders retain 49% of the company

As we mentioned, a liquidation preference defines the payout order in the event of a company's liquidation. It simply refers to how the proceeds from the sale of shares are distributed.

The first type we're discussing, the one-time non-participating preference, means that holders of preferred shares are entitled to receive their initial investment back before any other distributions are made.

For example, if seed investors have invested $7 million, they are entitled to receive this amount first. The distribution follows a "waterfall" sequence where the most recent (senior) investors are paid first.

How the Waterfall Would Work in This Scenario:

The initial $7 million first goes to the seed investors.

Then, the following $2 million goes to the pre-seed investors.

Lastly, founders, who typically hold common stock, are at the bottom of the waterfall and receive payouts last.

This sequence of payments is why it's called a "waterfall"—funds cascade down from the most senior to the most junior stakeholders.

This arrangement becomes crucial, particularly in scenarios where the company does not perform well or must be sold for less than expected. In such cases, liquidation preferences act as downside protection for investors.

This is why understanding liquidation preferences is essential for founders, as it directly affects their potential financial returns in various exit scenarios. Let's delve deeper into how this works and its implications for all parties involved.

Our following simulation maps various exit scenarios ranging from $0 to $50 million—the hypothetical sale price of the company. The table displays how the seed investors, pre-seed investors, and founders would receive funds across different exit valuations.

Impact of Liquidation Preferences on Founders and Investors

The structure of these payouts highlights a critical issue from the venture perspective.

For large exits, seed investors continually receive a fixed amount ($7 million), irrespective of the increase in the exit valuation. This fixed cap does not allow them to participate in the upside of more successful exits, which can be seen as a limitation.

To address this, most investor rights agreements include a clause allowing the conversion of preferred stock into common stock at any time.

This conversion option is crucial as it enables preferred stockholders to participate in larger gains beyond their fixed liquidation preference during highly successful exits.

For example, in a hypothetical $50 million exit scenario, holding onto preferred stocks with their original terms would yield only $7 million due to the liquidation cap.

However, converting those shares to common stock could significantly increase the return, aligning the investor's potential gains with the company's overall success. This conversion is an essential feature, ensuring that investors can benefit from the full growth potential of the enterprise they've funded.

As-Converted Scenario

Sure, let's simplify the explanation regarding the conversion of preferred shares to common shares, which we call "As-converted."

In the "As-converted" scenario, all shares—both preferred and common—are treated equally. This means that there are no special liquidation preferences.

Every shareholder gets paid at the same time, and their payout is proportional to their ownership percentage in the company. This approach differs significantly from the standard liquidation preference, where payouts are structured and often capped based on initial investments.

Essentially, VCs will choose whichever option—maintaining liquidation preferences or converting to common shares—maximizes their returns based on the exit scenario.

The graph below shows how payouts to different groups change based on the sale price of the company (Exit value, Slide_2), illustrating the shift from fixed liquidation payouts to proportional payouts upon conversion to common shares.

Participating Liquidation Preference

The participating liquidation preference is more advantageous for VCs. Not only do they get their initial investment back as with the non-participating preference, but they also participate in any additional distribution of funds. This means that after the initial investment amounts are returned (e.g., $7 million to seed and $2 million to pre-seed investors), any remaining funds are then distributed proportionally according to shareholding.

Here's how it works in practice:

Initial Payouts: In an exit, seed and pre-seed investors first recoup their investments just like in the non-participating scenario.

Subsequent Distributions: Once these initial payouts are made, any remaining funds are then shared among all shareholders, including the VCs, according to their respective equity percentages.

For example, in our simulated scenario, if there is $1 million left after covering the liquidation preferences in a $10 million exit, this amount is distributed based on ownership. If the founders own 49%, they would receive 49% of the $1 million, or about $490,000.

🍰 Strategic Considerations and Market Realities

These negotiations reflect market dynamics—investors with capital leverage their position to secure terms that mitigate their risk and maximize their potential returns.

The "waterfall" setup, where payments cascade from the most recent investors back to the founders, is a strategic and negotiated hierarchy that balances risk and reward among all parties involved in a venture.

Understanding these mechanisms is crucial for founders and investors, as it directly affects their potential financial outcomes from the venture and illustrates the importance of negotiation power and timing in venture capital deals.

When deciding on the type of liquidation preference during initial investment rounds, it's important to recognize that these choices could set a precedent for subsequent funding rounds.

Thus, founders need to be strategic and forward-thinking when agreeing to terms, consult a legal expert to make the most informed decisions possible, and consider not just immediate funding needs but also how these decisions will impact future rounds and the eventual exit scenario.

Thank you for reading and supporting us! ❤️

We are thrilled to see our community grow stronger every day. A warm welcome to our new subscribers and a heartfelt thank you to everyone who supports and follows us week after week! 🙏🏻

Before you go, don’t miss our latest Deep Tech Briefing!

💡 Insights on crucial facts from the week shaping the Global Deep Tech landscape at the intersection of technology, policy, and markets.

Get practical insights from cutting-edge tech innovations to the most significant startups and capital moves to stay ahead, and seize new market opportunities.