Welcome back to Deep Tech Catalyst, the channel where science meets venture!

We're excited to welcome Daniel Franke, Investment Director at M Ventures!

Today, we'll decode the intricacies of a cap table, exploring its importance for founders and investors and delving into the basic math behind it.

If you deal with pre-seed or seed rounds in Deep Tech, don't miss this episode!

Let’s dive into it!

🎧 Prefer to listen?

Before diving into it, an important disclaimer:

This content is provided solely for educational and informational purposes and should not be interpreted as financial or legal advice. While we strive to clarify the complexities surrounding various agreements and provisions, the nuances can be overwhelming. It is essential for entrepreneurs and founders to consult directly with a qualified legal or financial professional to navigate the legal and financial landscapes effectively.

Understanding these topics goes beyond merely knowing the terms; it involves grasping their implications for your ownership, control, and the broader future of your company. Preparing for a range of outcomes and being well-informed about how different scenarios might impact your stake in the business is paramount.

📃 What is a Cap Table, and Why is it so Important for Founders and Investors?

Let's delve into the intricacies of the cap table and unravel its importance for both founders and investors. Simply put, the cap table, short for capitalization table, is a cornerstone document for any company. Think of it as a blend of a birth certificate and a company's CV.

At its essence, the cap table provides a straightforward breakdown of who owns what percentage of the company. But beyond this fundamental ownership structure lies a wealth of information. You'll find details on different classes of shares, like preferred and common shares, as well as options reserved for employees.

Ownership + Control

However, the crux of the matter isn't just ownership; it's control. While ownership often translates to control, navigating control issues within a cap table can be complex. There are governance matters, voting rights, and control provisions that dictate who wields power in decision-making processes.

Understanding control is paramount. It's not merely about owning shares but about steering the company's direction. To grasp the full picture painted by a cap table, one must also consider the company's governing documents. These include agreements like the stock purchase agreement, investor rights agreement, and voting agreement.

Protective Provisions

Protective provisions, often included in these agreements, grant investors certain controls to ensure alignment with the founders' vision. These provisions cover various scenarios, such as starting subsidiaries, taking on debt, or changing leadership. While they may seem stringent, they serve to safeguard investors' interests and maintain alignment between founders and investors.

Moreover, these provisions become particularly critical during exit events. For instance, drag-along clauses stipulate that if a majority agrees to sell the company, others are "dragged along" into the sale. Such clauses prevent conflicts that may arise when parties disagree on selling the company.

🔍 Items of a Cap Table

Common Stock

At its core, common stock represents the basic unit of ownership in a company. It's what founders, early employees, and sometimes advisors hold. Imagine you're fresh out of university, and decide to launch a startup with your professor and another colleague. In this scenario, you all would likely start with common stock.

Preferred Stock

However, the equity landscape changes as soon as you introduce external investors into the mix. Investors typically negotiate for preferred stock, which, as the name suggests, comes with a set of privileges not afforded to common stockholders. These privileges can include protective provisions, giving investors a measure of control and assurance over their investment.

Liquidation Preference

One of the most critical aspects of preferred stock is liquidation preference. This concept becomes particularly relevant if the company doesn't hit the high marks everyone hopes for. Should the company be sold for less than its valued worth, liquidation preferences ensure that investors are paid out before any distributions are made to holders of common stock. This setup provides a downside protection for investors, prioritizing their investment return before any payouts are made to employees or founders.

Options

Another element often seen on cap tables is options. Unlike common or preferred stock, an option doesn't represent immediate ownership. Instead, it gives the holder the right to purchase shares at a predetermined price in the future. Options are a common way to incentivize employees, allowing them to buy into the company's success at a later date.

When things go well, employees can exercise their options, essentially converting them into shares.

When evaluating a cap table, it's crucial to consider options as part of the fully diluted shares, meaning you assume all outstanding options will eventually be converted into shares. This perspective gives a more comprehensive view of potential ownership distribution, including how it affects both the economic and control aspects of the company.

🧮 Cap Table Math for Deep Tech Startups: A Simulated Case Study

Navigating the complexities of setting up a fair and accurate cap table can be daunting, especially for scientists venturing into the realm of startup ventures.

It is essential for entrepreneurs and founders to consult directly with a qualified legal or financial professional to navigate the legal and financial landscapes effectively.

For today’s educational purpose, let's outline the stages of a hypothetical company through a simulation of founding, followed by pre-seed and seed funding rounds.

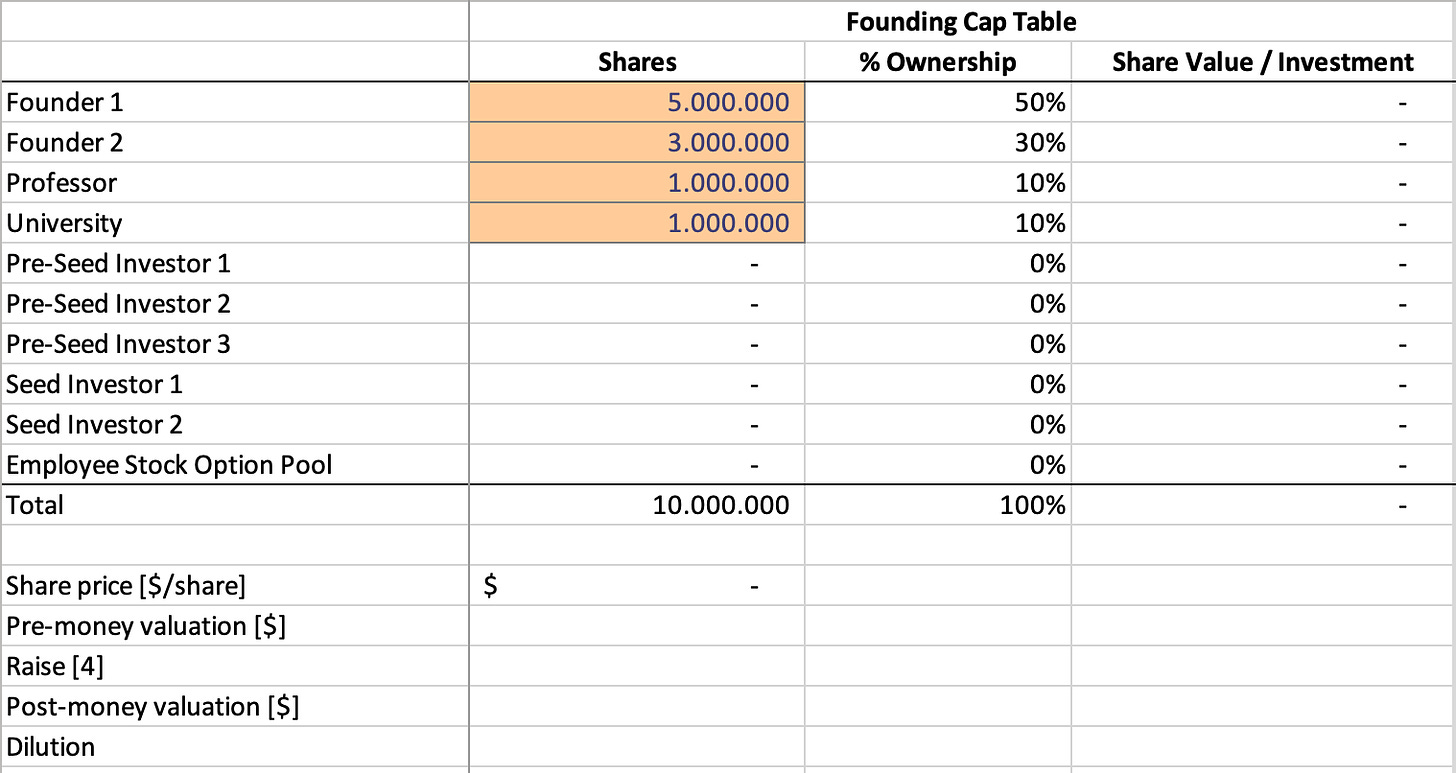

Founding Cap Table

We'll begin with a typical scenario, envisioning a university spin-out venture.

In this setup, there are typically two founders, one of whom might have contributed more significantly, a professor, and the university itself, which often retains a stake in spin-outs deriving from its intellectual property.

Why so many shares?

Now, you might wonder why the share numbers seem exceptionally high, reaching into the millions. This is primarily due to the practical constraints of share divisions; shares are indivisible units, and fractional ownership isn't feasible.

Hence, to facilitate accurate calculations, larger share numbers are utilized.

At the outset, with four entities on the cap table, comprising the two founders, the professor, and the university, the total share count stands at 10 million. For example, if Founder #2 owns 3 million of these shares, they possess a 30% stake in the company from its inception.

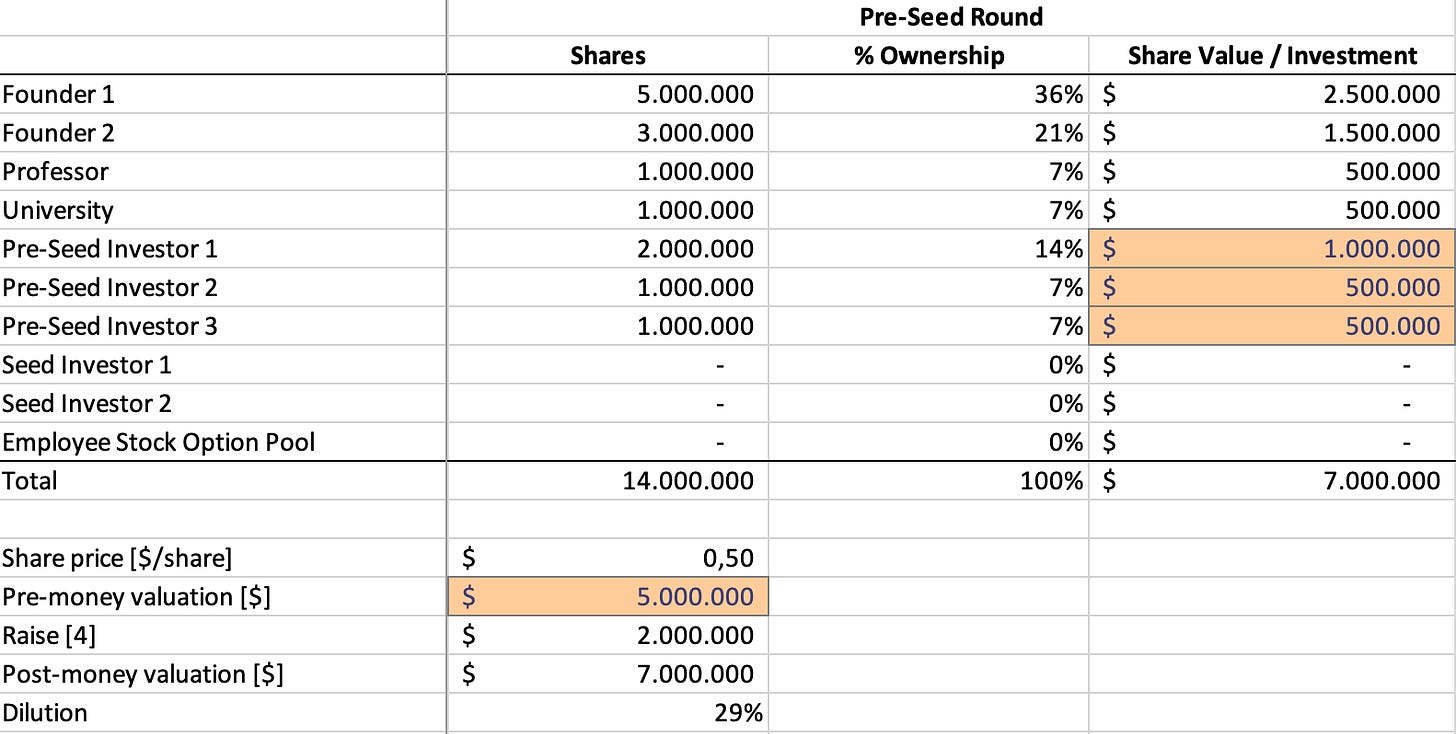

Pre-Seed: Approaching the First Investor

As we move into the negotiation phase, things start to get more intricate. There are numerous aspects to navigate when dealing with investors, but for the sake of simplicity, let's focus on two key elements: the raise amount and the valuation.

Imagine you're an investor evaluating a company.

You've done your due diligence, and you're impressed by the team and the technology they're developing. Now, it's time to discuss the economic terms. Valuation, in essence, is a matter of what people are willing to pay for a company. While complex models and spreadsheets can be utilized, ultimately, it boils down to negotiation between you and the investor.

In the public stock market, share prices fluctuate continuously, but in the realm of private companies, shares are typically only transacted during financing rounds. At this point, the valuation of the company is determined by what the investor is willing to pay. Hence, the negotiation revolves around how much money is being raised and at what valuation.

Pre-money Valuation

Pre-money valuation, which signifies the company's worth before the investment, is a crucial metric. To calculate the share price, one simply divides the pre-money valuation by the total number of shares. For instance, if the pre-money valuation is $5 million and there are 10 million shares, the share price would be $0.50.

Once the share price is established, investors can determine how much they want to invest. For example, if an investor decides to invest $1 million at a share price of $0.50, they would acquire 2 million shares. This process repeats for each investor participating in the round.

After the investment, the company's post-money valuation can be calculated by adding the capital raised to the pre-money valuation. This figure represents the company's value after the investment round.

However, raising funds often leads to dilution of ownership for existing shareholders.

For example, if a founder initially owned 50% of the company but raises capital, their ownership percentage will decrease. Basically, this dilution is a trade-off for accessing capital to fuel the company's growth.

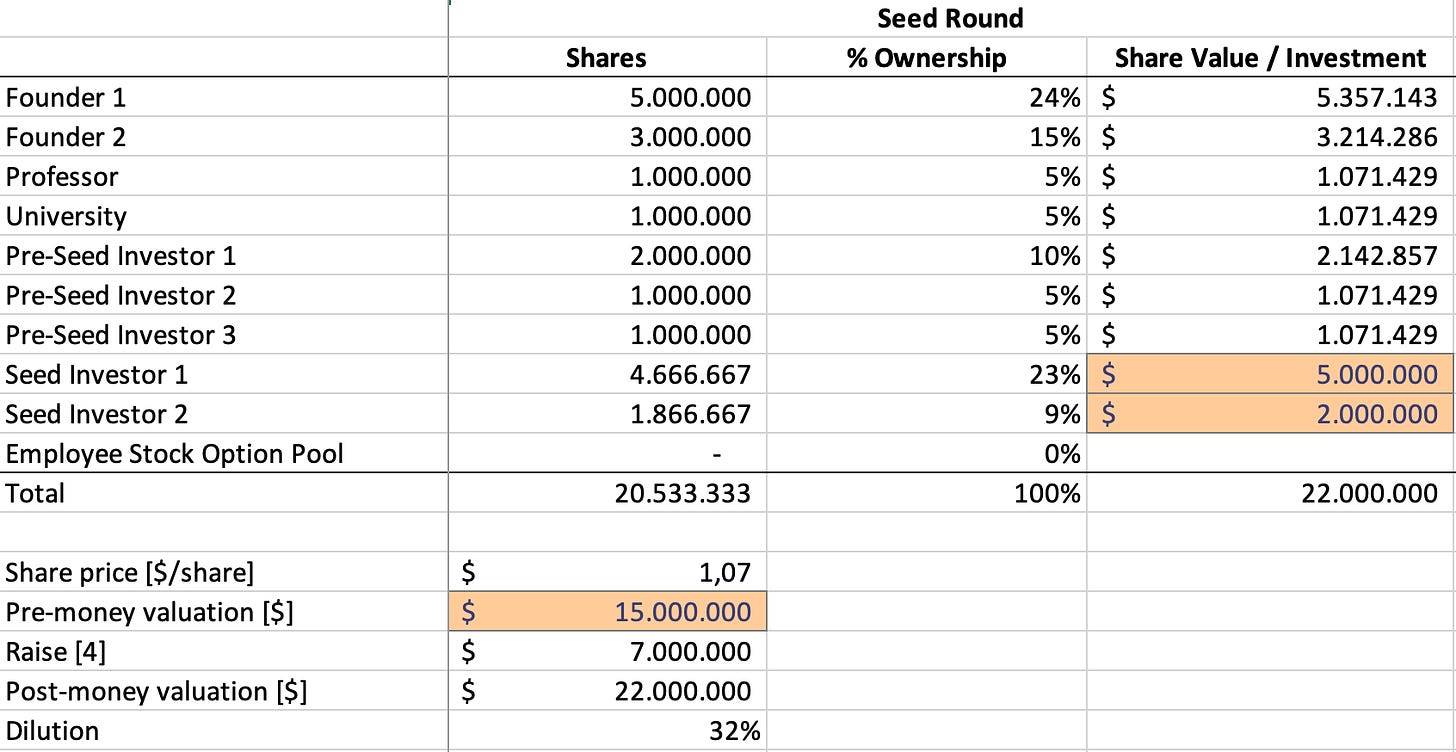

From Pre-Seed to Seed

Now, let's delve into the dynamics of the subsequent funding round. Imagine you've efficiently utilized the initial $2 million over a span of a year or two, achieving significant milestones along the way.

As you seek additional funding, let's say around $7 million, from a new set of Seed investors, you find yourself in a position to negotiate a higher valuation.

With the Seed investors impressed by your progress, you collectively settle on a $15 million pre-money valuation.

Essentially, you determine the new share price by dividing the $15 million valuation by the total number of shares, resulting in a higher share price compared to the previous round. As you sell more shares to accommodate the new investment, your post-money valuation climbs to $22 million.

Dilution

However, with every funding round comes the inevitable dilution of ownership for existing shareholders. Despite retaining the same 5 million shares, the founder's ownership percentage decreases from 36% to 24% due to the increased number of shares issued. While this may seem like a drawback, it's crucial to recognize that the value of the founder's shares has actually appreciated. With the new share price at $1.07, their shares are now worth more than $5 million, a considerable increase from the previous $2.5 million valuation.

While it's normal to feel apprehensive about losing control as your ownership diminishes, it's important to acknowledge that it's part of the process. Investors contribute capital to the company and understandably seek a degree of control in return.

🚩 Can a Wrong Cap Table Be a Red Flag for a VC?

From an investor's perspective, well-structured cap table is essential for build an investable company. Here are some common considerations:

Proper Incentivization: It's essential that the individuals driving the company forward, such as founders and key employees, are adequately incentivized with equity. Sometimes, we encounter situations where individuals crucial to the company's success don't hold enough equity, leading to misalignment of incentives.

Internal Misalignment: Discrepancies in equity distribution among founders or employees can lead to internal strife. For instance, if one founder significantly outpaces the others in terms of effort and contribution but holds a smaller share of equity, it can create resentment and hinder team cohesion. Therefore, it's crucial to ensure that equity allocations reflect each individual's contribution to the company's success.

Cap Table Length: While not as common in early-stage companies, longer cap tables become more prevalent as companies mature and undergo multiple funding rounds. However, an excessively long cap table can pose logistical challenges, particularly when seeking shareholder approval for corporate actions. Managing numerous investors, each with a small stake, can slow down decision-making processes and create operational inefficiencies.

Diverse Investor Base: While having a wide investor base can be beneficial for diversifying risk and accessing different expertise, it can also complicate matters, especially if dealing with numerous smaller investors. This issue is often unavoidable, particularly if a company needs to raise funds from various sources, including smaller funds, angel investors, or family offices.

Prevent a scenario where a single investor holds absolute control over the company: This is a concern particularly with investor shares. Ideally, we aim for a balanced distribution of power among investors, ensuring no single entity can unilaterally dictate the company's direction.

Let's revisit the pre-seed round for a moment.

We have three investors: Investor #1 with $1 million, and 2 others, each with half a million, totaling another million. Most shareholder decisions rely on the classic majority vote scenario.

In this case, it seems balanced since no single investor holds a majority. However, if Investor #1 were to possess just one more share, they'd tip the scales, gaining control over all the preferred provisions. This concentration of power can be problematic, leaving other stakeholders at the mercy of a single investor's decisions.

To Sum Up

In essence, a well-crafted cap table should maintain balance among employees and investors while facilitating efficient decision-making processes. It must reflect equity in line with investment contributions and acknowledge the hard work of those driving the company forward. These considerations ensure the cap table's equity, effectiveness, and protection against undue influence, serving as pillars for sustainable growth and investor confidence.

This is all for today!

Wanna be more involved?

👉🏻 Follow our LinkedIn page and drop a DM!

👉🏻 Write us a line here: info@thescenarionist.org

See you next week! 👋